Mashery: Measuring API Program Success

Editor's note: this is a "Sponsor Post", by one of our long-term sponsors. These posts are clearly labeled as such, but we also want them to be useful and interesting to our readers. We hope you like the posts and we encourage you to support our sponsors by trying out their products.

API publishing is no longer the future; it has clearly arrived. Companies from Best Buy to MTV Networks have jumped into the game, and more are taking the plunge every day. But what differentiates a successful API program from one that "never leaves the station"? ...

XBRL: Mashing up Financial Statements

Amid the dark days on Wall Street and in global markets, it seems to be up to technology to step up and deliver solid analysis and rational scrutiny. The US market regulator, the Securities and Exchange Commission (SEC), ratified a proposal on Wednesday for public companies and mutual fund companies to file their financial statements in XBRL (eXtensible Business Reporting Language). The XML-based language is also known as "Interactive Data" in financial circles and promises faster analysis with wider coverage. All things being equal, it will mitigate the poor analysis and regulation that's been contributing to stupendously bad financial decisions.

Amid the dark days on Wall Street and in global markets, it seems to be up to technology to step up and deliver solid analysis and rational scrutiny. The US market regulator, the Securities and Exchange Commission (SEC), ratified a proposal on Wednesday for public companies and mutual fund companies to file their financial statements in XBRL (eXtensible Business Reporting Language). The XML-based language is also known as "Interactive Data" in financial circles and promises faster analysis with wider coverage. All things being equal, it will mitigate the poor analysis and regulation that's been contributing to stupendously bad financial decisions.

This is a guest post by Derek Abdinor.

Companies have traditionally filed on paper, in ASCII, or in HTML: all essentially lifeless formats for conducting any meaningful comparison or analysis. With XBRL, every line item is given a tag that identifies it and its role in the financial statement. Imagine that a line item -- say, "Net Income" -- is tagged like a migrating goose (which frequently happens, I'm told). That goose is part of a flight of geese, which may change their course mid-flight, fly over national borders, have babies, and even join another flight. But thanks to the vital information on the goose's tag, we never lose the original information, and we are even able to see it in the context of other information.

Financial accounts are the same. Figures get re-purposed all over the place, which leads to input errors, or worse. It's easy to cover up information or fail to notice business risks when the analysis is relegated to a footnote somewhere, and you're reading the annual report like a "Choose Your Own Adventure" book.

When financial data is tagged, it's begging to get mashed up. Take a look at this comparison of executive pay, this dynamic charting, and the SEC's own repository and viewer. Software exists that can be first used upstream with the creation of management accounts and go all the way through to taxonomy design, document tagging, and viewing. One would be able to call up income statements of two or more companies in different sectors and different countries and compare line items in seconds.

But to see XBRL simply as a means of marking up financial statements at the end of a financial reporting period is to miss the rest of the iceberg. If financial items are automatically tagged upon their creation using a system like SAP, the rich analysis can be filtered through the enterprise and to suppliers. Triggers and reports can be generated on the fly. Knowledge workers will be manipulating XBRL without knowing it by its accurate, albeit consonant-heavy, name.

XBRL, by its nature, has largely escaped the wave of Enterprise 2.0 functionality. But the openness of the data, its ability to be mashed up and displayed in previously unthought-of ways, will impress itself upon a public disillusioned with poor financial management -- management that has itself partly relied on poor data. It's time for some developer rock stars to step in and make those spreadsheets sing.

More about XBRL

Often described as being simply complex, XBRL should be approached from a technological, as well as an accounting, perspective. XBRL is simply a flavor of XML. Financial line items, totals, text, and metadata are XML elements that are mapped to a predefined schema (called a "taxonomy" in XBRL). In all cases, these taxonomies are the financial rules of accounting for that jurisdiction. Throw in XPath, XLink, and more, and you have a mature language for tagging and submitting your financials.

An introductory resource to begin with is Wikipedia, which links to the various regulatory bodies, IT initiatives, and current issues. The "XBRL in Plain English" video is specific to executive summaries.

This was a guest post by Derek Abdinor, a divisional director at motiv - the Investor and Branding agency of Ince, a large communications concern from South Africa.

Add Stock Quotes To Every Post With Upcoming Wikinvest Plugin

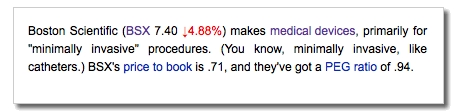

Financial bloggers are going to like this one. Wikinvest is getting ready to release a Livequotes plugin that automatically adds a stock quote every time a publicly traded company is mentioned in a post. It auto-detects company names and adds the ticker symbol, price, and the percent change in parentheses after the name, with links to the Wikinvest page for that stock. It also can add links for financial terms and definitions such as “PEG ratio” or “price to book.”

The plugin works on Wordpress and Blogger right now, and will launch officially in a couple weeks. But Wikinvest will give 10 TechCrunch readers early access. State in comments why your site or blog is deserving and how your would use the plugin, or email Wikinvest founder Parker Conrad (parker [at] wikinvest).

The plugin works automatically, potentially cutting out a few steps for financial bloggers who often include links to stock quotes in their posts. For ambiguous company names, there’s a backup to the auto-detect feature: simply put the desired stock quote in double brackets like [[AAPL]]. It will look like this:

But instead of just spamming your blog with a bunch of links back to Wikinvest (because, let’s be honest here, that’s what this is really all about), it adds a box inside the editing pane of Wordpress or Blogger that previews the links it will add. Any links a blogger doesn’t want can be unchecked before the post goes live.

Wikinvest will soon add support for other financial quotes beyond stocks, such as for currencies, commodities, and interest rates.

Scrapplet: Powerful Social Web Canvases That Are As Easy As Drag-And-Drop

There are a few sites out there that let you aggregate your entire online presence into a single place, but for the most part they offer little control over the way your information is actually presented. Today sees the launch of Scrapplet, a powerful new website/platform based entirely on JavaScript that allows users to design pages combining all of this information to their liking using a WYSIWYG interface. The site also offers a dizzying array of options - so many, in fact, that the site could be used by experienced developers to create pages that go far beyond showing off your interests and favorite photos.

CEO Steve Repetti stresses that Scrapplet isn’t another social network - rather, it’s a place for you to compile all of your information from sites across the web and present it however you’d like. The site gives users a blank canvas, allowing them to import information from sites including Facebook, Twitter, MySpace, RSS feeds, and a number of other sources. You can also embellish your profile with music, embedded videos, and images.

Once you’ve imported all of your content, you can drag and drop each item wherever you’d like in your canvas. Each item also has a properties menu that allows you to customize how it should behave (for example, you can determine if it should have a border or if it should “stick” to another item on your canvas, or if should move independently when it’s dragged). More advanced options include a Timer, Rollover, and OnClick actions that allow you to execute commands accordingly.

No comments:

Post a Comment

Comments accepted immediately, but moderated.