By Dina Bass

April 13 (Bloomberg) -- Microsoft Corp. beat Yahoo! Inc. and Google Inc.’s YouTube for a seven figure advertising campaign with Discovery Communications Inc., its first to simultaneously combine Internet, mobile and video-game ads.

To promote Discovery Channel’s fifth season of the crab fishing documentary “Deadliest Catch,” Microsoft came up with a package of ideas it has never tried before. Ads will take over the MSN.com and MSN mobile homepages and 90 percent of ad space on MSNBC and Fox Sports sites. Microsoft will run sweepstakes in video-games like ‘Shaun White Snowboarding’ and send text- message reminders to phones to watch or record the show.

“Microsoft just came in like rock stars on this,” Donna Murphy, the Discovery Channel’s vice president of marketing strategy, said in an interview. “They were the first ones to really blow it out in every direction.”

It’s a victory for Microsoft, which is fighting for sales of display ads in an online ad market expected to post the slowest annual growth since 2001, according to Sanford C. Bernstein & Co. With Google having virtually locked up the market for ads that appear next to Web search results, Microsoft and Yahoo are fighting for a display market that will only grow 1.5 percent this year, compared with 37 percent in 2007, Bernstein said.

Separate Teams

Microsoft couldn’t have pulled off a campaign like this until recently, said Keith Lorizio, a vice president in Microsoft’s ad sales group. Separate teams handled Web sites like MSN.com, MSNBC and Fox Sports, ads on mobile phones, video- games and the Xbox Live Internet service -- and usually didn’t work together. Account representatives lacked expertise in newer mobile and video-game ads, so they pushed the same old banner ads on MSN.com that they knew best, Lorizio said.

“If Discovery would have come to us in the past, the ball would have gotten dropped in the handoff of trying to go across all these different properties,” he said. “We never would have had such a diversified campaign.”

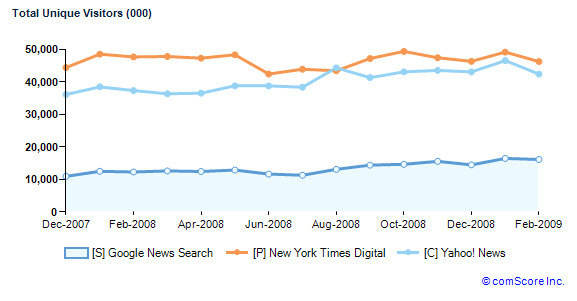

Microsoft MSN’s share of the display market fell to 8 percent in the fourth quarter, from 12 percent a year earlier, according to Nielsen Online, which tracked how many times ads were shown to users. Yahoo’s share increased to 30 percent from 25 percent. The average price Microsoft charged for ads also fell, according to Bernstein.

Microsoft, based in Redmond, Washington, rose 48 cents to $19.67 on April 9 in Nasdaq Stock Market trading.

Frosted Mini-Wheats

To promote the premiere of “Deadliest Catch” tomorrow night, Discovery will take over MSN.com, MSNBC and Fox Sports, the first time those sites have devoted so much space to a single advertiser. A mobile-phone contest will give away points that can be used to purchase video-games and movies from Microsoft’s Xbox online service.

Another campaign the company says is a model for the future is a promotion for Kellogg Co.’s Frosted Mini-Wheats, where Microsoft created an online community for the cereal brand that let moms discuss children’s education.

Microsoft says it needs more campaigns like those. “People are not doing a good enough job coming into meetings with creative ideas,” said Scott Howe, a Microsoft corporate vice president promoted in December to oversee ad products. “It will take time to improve.”

The display ad market overall is suffering as competition has pushed down prices by an average of 30 percent to 40 percent in the past year, Lorizio said.

Recession Pressure

Display -- including banners and animated ads -- will account for a quarter of global Web-ad revenue this year and grow 1.5 percent, according to Bernstein. Those categories don’t include things like classifieds and direct e-mail offers, as well as newer areas such as mobile and ads in online TV shows and YouTube videos. By comparison, search comprises 35 percent of the market and should grow 11 percent, Bernstein says.

No single ad vendor has figured how to dominate in display and clients are still trying to determine how to make these types of ads consistently profitable, said Discovery’s Murphy. The recession is increasing the pressure.

“There are fewer dollars in the market right now and everybody is having to get innovative in terms of how are we going to make everything work a little harder,” she said.

In the boom years for Internet advertising, clients automatically put Microsoft, Yahoo, and other big Web sites in their campaigns, Howe said. Now companies that had grown used to an industry expanding more than 20 percent a year must fight for a place.

‘Bread and Butter’

Microsoft’s display revenue, the “bread and butter” of the company’s $2.46 billion ad business, is now increasing at a rate of less than 10 percent, according to Robin Domeniconi, Microsoft’s head of U.S. ad sales and Lorizio’s boss.

“I don’t think we’re going to see double digits until the economy turns around,” said Domeniconi, a former publisher of Real Simple magazine hired in November to inject more creativity and focus into Microsoft’s display business.

Microsoft may be having a hard time partially because competitors offer software with more advanced features for tracking ad viewers closely and measuring the effectiveness of ads, Microsoft and clients say. It’s been too hard to mount a campaign across different Microsoft sites, phones and video- games. Clients who do manage it can receive four different bills, Howe said.

Yahoo Distraction?

David Kenny, who oversees online advertising for Paris- based Publicis Groupe SA, the world’s fourth-biggest ad company, said that as Microsoft spent months last year on a failed bid to acquire Yahoo and its search business, there seemed to be less of a focus on display. That made him reluctant to funnel his clients’ business to Microsoft.

Howe was surprised when told of that sentiment: “If that’s the signal we’re sending out, I have to rethink what I’m saying to the market.”

Kenny, whose clients include General Motors Corp. and Procter & Gamble Co., has been spending more with Google, whose software can do things like show ads only to customers who have access to credit and have used it in the past, he said.

“Microsoft’s ability to come to us with interesting ideas just went by the wayside,” he said.

Range Online Media, which develops campaigns for companies like Gap Inc., has also switched to Microsoft’s rivals to target ads. For example, when a user looks at sandals at an online shoe store, Range needs to keep track of that user as they visit other sites. That way, Range can keep showing ads for sandals. Range also wants to automatically show that user related ads for a set period of time following the shoe-store visit.

Targeting Features

Neither of those strategies can be done with Microsoft’s software, says Camille Ip, account leader at Range.

Microsoft does have some targeting features, but they’re not available across all of its many properties, said Range President Misty Locke. Locke praisedMicrosoft for being receptive to Range’s concerns. She just wishes the improvements would come faster.

Microsoft is playing “catch-up” said Lorizio, and plans a new release of software for targeting and analyzing campaigns this year.

“It’s a very performance-oriented, data-driven business and we should be better,” he said. “It is absolutely critical for us to improve. Every marketing executive needs to be able to turn around and show the return on investment for using us.”

AQuantive Purchase

Microsoft, which spent $6 billion to purchase Howe’s former company, AQuantive Inc., in 2007, needs to integrate its acquisitions to make it easier for clients set up broad campaigns, Howe said. That, rather than more acquisitions, will be the unit’s focus for the next 18 months, he said.

The company has already spent nine months reorganizing its ad sales force so account managers can turn to specialists in areas like games and mobile phones without making the customer do the legwork. In the case of Discovery, as many as 14 Microsoft employees worked on the “Deadliest Catch” campaign but Discovery only had to deal with their account representative, Lorizio said.

As for the multiple-bill problem, Microsoft has made headway with that too. “Discovery won’t get four bills,” Lorizio said. “But they will get more than one.”

To contact the reporter on this story: Dina Bass in Seattle atdbass2@bloomberg.net