Ed: Good analysis, but simplistic and superficial with respect to online advertising. As an econometrician of world markets, it's always been difficult to simplify multivariate, multi-equation, dynamic models so that Wall Street pundits depend on stochastic input-output models. Wall Street looks at historic results. Analysts poorly model the process of cause, effect, stimulus, and temporal impacts.

- Another chicken-little forecast of the economy that ignores the "one time in history" economic stimulus from rapid price deflation. Is 2000 relevant? Did Morgan Stanley even identify the current spike event as relevant?

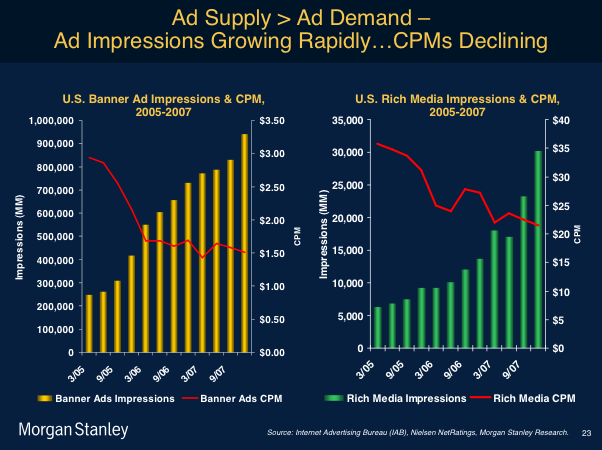

- Advertising total demand grows slower than total supply - leading to price declines. This assumes commodization of ad inventory. As long as publishers act like lemmings and blindly follow current practices, the result would be commodization and falling prices. How can publishers avoid commodization? Will exitmercials change the economics of advertising?

- Why is Google growing? Why are display CPM's declining? What do advertisers really want?

Every year at the Web 2.0 Summit, Morgan Stanley Internet analyst Mary Meeker gives her view of the world, the Web, and the technology industry by quickly going through about 50 slides that illustrate the major trends she is tracking. Last year, she zeroed in on the China Bubble. This year, she talks about the root causes of the current economic downturn, the outlook for Web businesses, and where she still sees major growth (mobile and emerging markets).

She singles out the mobile industry as the one where both the most opportunity will be found and disruption will occur over the next five years. Moreover, she suggests that the U.S. is poised to lead the transition in mobile to a Web-centric model. (I totally agree). Interestingly, she points to the introduction of the first Android phone by T-Mobile, not the launch of the iPhone, as the key inflection point for the coming era of the mobile web.

Meeker’s full presentation, which she gave yesterday, is in the video embedded above and her full slide deck is below (thank you, Henry Blodget, for uploading them). The slides are also available here.

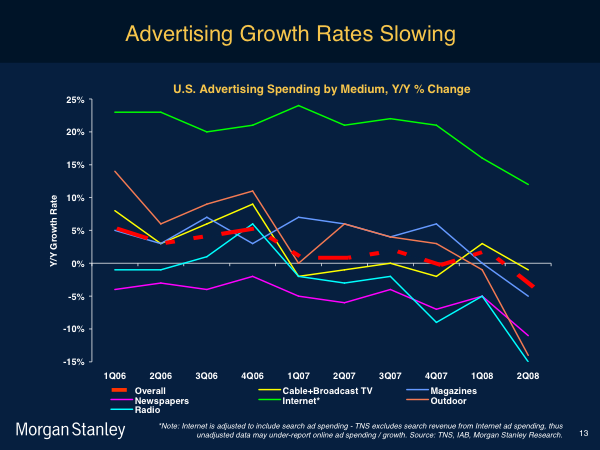

A few slides in particular stuck out for me. First, the growth rates for both e-commerce sales and Internet advertising are normalizing much faster than anyone expected they would compared to offline growth rates for retail sales and advertising. No doubt, this steep slowdown in growth is being compounded by the overall economic situation. ...

In the second slide, the top green line is Internet advertising growth. At least it is still above all the other kinds of advertising and not yet in negative territory, but the trend does not look good.

In fact, as ad budgets decline and Web pages keep growing, the bigger problem is that the supply of ad slots on the Web is becoming greater than the demand to fill them. The only way to fill those slots is to lower the price of each spot. As the slide below illustrates, ad impressions keep growing, but the cost per thousand (CPM) keeps dropping (on average, to about $1.50 for banner ads and to just above $20 for rich media ads):

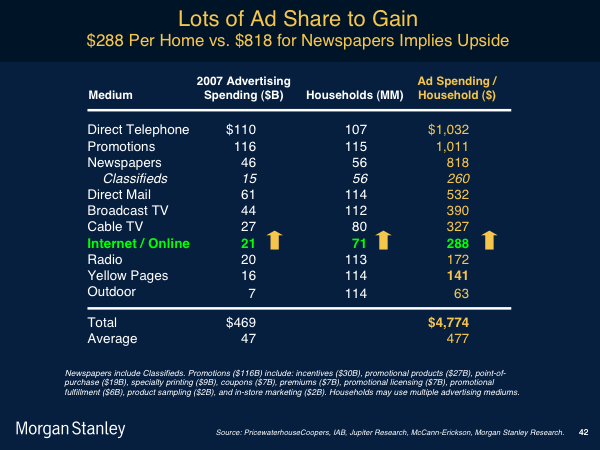

On the bright side, compared to the overall spending on other forms of advertising such as TV, print, and direct mail, Internet advertising still has a lot of share to gain, and will likely continue to do so.