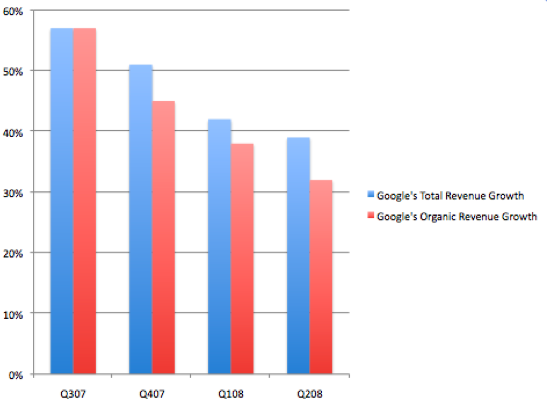

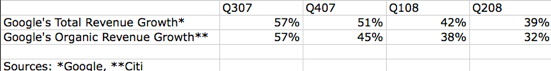

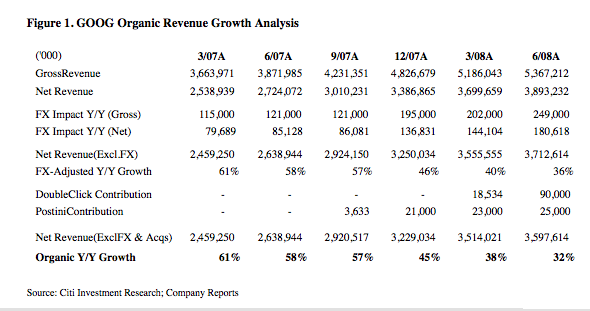

Google pulled in $5.37 billion in revenues Google does not break out its organic revenue numbers (the revenue from its core businesses, not including contributions from recent acquisitions I’ve put his organic growth rate estimates together with Google’s reported total revenue growth rates for the past four quarters in the chart and table above. In the third quarter of last year, both growth rates were the same: 57 percent. By the second quarter of 2008, Google’s total revenue growth rate had settled down to 39 percent, but its estimated organic growth rate was significantly lower, at 32 percent. What this suggests is that Google’s core search advertising business may be decelerating faster than a glance at Google’s quarterly income statements would indicate. It also highlights how important it is for its biggest acquisition, DoubelClick, to make up for the slack. And, of course, it would be nice if Google could start making money from its underperforming businesses such asYouTube, Postini, and Google Checkout Update: Here is Mahaney’s detailed analysis.

last quarter, and $1.25 billion in net profits (nearly ten times what Yahoo made last quarter). Yet behind the consistently amazing financial performance, a few chinks are beginning to appear in Google’s armor. The biggest one may be the increasing gap between its organic revenue growth and its total revenue growth.

last quarter, and $1.25 billion in net profits (nearly ten times what Yahoo made last quarter). Yet behind the consistently amazing financial performance, a few chinks are beginning to appear in Google’s armor. The biggest one may be the increasing gap between its organic revenue growth and its total revenue growth., investments, interest, or foreign exchange fluctuations). But in a note put out on Friday, Citi analyst Mark Mahaney gave his estimates of Google’s organic revenue growth. He warns, “We have seen steady and material deceleration in GOOG’s organic revenue growth,” and he expects that trend to continue in the third quarter as well. (Even so, he still reiterates his buy rating on the stock). (some of which, themselves, were acquisitions). Mahaney estimates that DoubleClick contributed $90 million in revenues last quarter, and Postini contributed $25 million.

(some of which, themselves, were acquisitions). Mahaney estimates that DoubleClick contributed $90 million in revenues last quarter, and Postini contributed $25 million.

Aug 10, 2008

Does Google Have An Organic Growth Problem?

1 comment:

AnonymousAugust 12, 2008

AnonymousAugust 12, 2008Interesting post and analysis by Citi and glad to see you guys picking up on it. We've benchmarked and analyzed the entire S&P 500 (of which Google is a member) on organic revenue generation and efficiency and our #s reveal a similar story, but the picture still is very positive.

ReplyDelete

In short, we would agree with Citi's analysis that the organic revenue as a % of total revenue for Google as well as a % of total revenue growth is declining over the longer period we studied. As compared to Yahoo (the closest comparable to Google if there is one), you can see however, that Google is destroying their peer from an organic revenue perspective.

Our analysis goes beyond just organic revenue and looks at the efficiency of generating this organic growth, e.g., how much are companies spending to achieve organic revenue growth. We call this efficiency ratio the Organic Growth Multiplier (OGM). The logic behind the OGM is that if one company can spend $1 to get $3 of revenue and another can spend $1 to get $5 of revenue, the latter company is healthier and has more momentum in its business and obviously superior organic revenue generation capabilities.

When we look at the OGM of Google versus Yahoo and versus the larger S&P500 tech financials category, the picture is actually quite pretty for Google. They're tops as it relates to OGM which means a dollar of their investment into their core business generates more revenue than the average tech sector company. They also outshine Yahoo on this count as well.

The indexed OGM for Yahoo and Google over the period from 2003-2007 are 50.9 and 312.84, respectively. Without getting into the quantitative models that underlie this, the point is that Google's organic revenue efficiency is far superior to Yahoo.

Lastly, we've seen that higher OGM and total shareholder return are positively correlated. So that that implies is that having the ability to generate organic growth efficiently is a good indicator of shareholder returns.

While the assertion that their organic revenue is declining does remain true, the news is not as dire as I've been reading elsewhere from those who've picked up on this post. Yes, if they can turn one of their acquisitions into a money maker, this will obviously supplement some of the organic revenue deceleration that might be evident in their historical core business, but on the whole Google is still a star when it comes to organic revenue generation and efficiency. The fact that Citi retains its buy rating despite the organic picture is testament to this.

A bit on the methodology.

There are some notable differences from the Citi analysis which despite the similar conclusions do make our analysis more robust.

1. We've looked at a more extensive time period (2003-2007)

2. We strip out market growth for each company. In essence, if the market is growing at 10% and your company grows at 10%, we don't give you credit for this. This is rising tide growth and is not due to management's actions and investments in the core business. Organic revenue, therefore, in our models is only the growth we can attribute to management's prowess (or lack thereof).

3. In our Organic Growth Multiplier, we also look at the efficiency of generating organic revenue by determining how much is spent by each company to achieve its organic revenue. This gives a truer sense for the efficiency of the company's organic revenue capabilities.

Thanks for the great post on organic growth - a topic not often discussed.

Regards,

Anand Sanwal

www.brilliont.com

Investile Dysfunction blog

www.brilliont.com/blogs/id

Popular Posts - Tag and Earn More

- Apple on a Roll

- Understanding Facebook for Web 1.0 Users

- eBook, Self-Publishing, Starving Writers Gain Ad-Supported ePublishing

- New Media: The Problem is Monetization, The Solution is $50.00+ eCPM

- Profiling the Internet and Online Advertising

- Contextual, Behavioral, and AI Targeting

- Internet Consolidation or Fragmentation

- New Internet Roles with Social Media

- Blogging Ecosystem of Distribution Gadgets

- SEO or 'Flypaper Effect'

- Reality Television Comes to Journalism - Thy Name is Blogger

- Feeds, Weeds, Reads, and User Needs

- Sex, Money, Power - The Anchor of Social Media

- Forum: Anyone able to earn $100+ eCPM

- Lead Generation, Direct Mail, eMail, Word-of-Mouth, Buzz Marketing, Social Media Compared

It is possible for Google for fill the holes created by their core search business decelerating, but they are going to have to concentrate on bringing all of their acquisitions together. Some of it just doesn’t make sense at all.

about the acquisitions… that’s mostly what they have been up to lately, it seems like. Some acquisitions don’t make sense though…I mean they have the knowledge to create something of their own… but it might end up like Knol..not such a hype. http://blabtech.blogspot.com

one trick pony, ad widget? what is google? google adsense and search results are barbaric. adsense equals spamsense. the experience and innovation they dont have nor posess they will buy. some people at google are defintely not doing there job. darn lazy billionaires.

If the numbers are correct its an emergency. .

“Google is Shrinking.” .

It’s a strange world indeed when youtube is considered an under performing business. Make me look very very small

Yes, and once they start putting ads, everyone will be complaining about it then also. You can’t satisfy anybody.

I really dont see why every one complains. To tell you the truth I never even notice ads. Ive been to youtube thousands of times and if you asked me if they have ads, i wouldnt be able to tell you.

‘And’ ?

I think one simple thing Google can do is get more creative with their ad units. They’ve stuck with the same format for way too long and most people are blind to them.

What if they adopted some ad units that combine images with text similar to BlogAds.com? How about put up ads on all of the embedded YouTube videos and share part of the revenue with those that embed the videos? I think this problem is as simple as having a brainstorming session… maybe they should hire Roger Von Oech?

Best suggestion (the image/text units) I’ve seen on here. They made it against the TOS when they saw the clickthroughs AdSense publishers were getting, but image next to text works.

They’d have too many legal issues to do the embed thing with YouTube though

I knew those pesticides were bad for you.

Companies are no longer falling for the “SEO” garbage they were all tricked into buying back in ‘05/’06. The sad truth is that Google’s best positions are reserved for Wikipedia entries and the huge sites on the internet that were big before and after Google came around and companies are no longer seeing a decent ROI from them.

Search engines like Google need to be reworked from scratch every 2-3 years to ensure new content has a chance to be seen or else the small guys (who Google makes most of their money from) won’t even bother anymore. Especially with all the click-fraud and non-control of ad placement that is common knowledge.

@Scott C. - The wikipedia positions you referred to are the organic search results which google doesn’t make any money from. Wikipedia and the other sites you mentioned don’t turn up in the paid-for search results so I don’t follow how re-working the search engine as you suggest would actually benefit anyone.

A lot of people simply do not appreciate how many backlinks Wikipedia has got -http://www.majesticseo.com/sea.....ipedia.org - you can see that Wikipedia has got 670 mln external backlinks from 1.3 mln domains. Nothing suprising that they rank well.

You just became a Trending Topic on Twitter

http://search.twitter.com/sear.....le+Have+An

I’d guess that Google Apps sales will become increasingly aggressive as well as create a real channel. I’d expect that to be across the SMB space as well as into service providers as the back office services that Google Apps provides become increasingly commodity.

i don’t know, but tonite is saturday nite and i’m having an orgasmic growth problem.

QoQ growth 3%

Well , The problem may be because it is all ready at the top and saturation.

The managers has to think now quite differently to improve its performance further.

Maybe it’s strategic buys and acquisitions should be considered (or not count against them) as true growth, as long as they can keep them profitable. I expect some very interesting new products debuting soon that will continue to fuel the company for a long time to come.

Here’s a question for ya - when was the last time you clicked on one of their ads? how often do you click?

I’m telling you man… they gotta get more creative.

I think a good idea would be if Steve Jobs could do to advertising what he has done to computers, mp3 players, cell phones, etc. Make ads cool, simple and fun.

In particular when I’m shopping for something, I click on the AdSense links quite a lot actually.

Economic recession!

Advertising frankly doesn’t work. I sell adverts on my site and buy them for customer acquisition and they don’t work. ECPm is pitiful even with being a google ad partner.

I’d also say 99% of people write their own ad copy too, because they can, but that doesnt mean they are advertisers. No-one readling this would imagine they could script a 30 second superbowl ad, but they still believe they can write copy. Perhaps it just takes time for people to realise that and google are going to run out of new people willing to chance it.

Also seeing more traffic now from MS and yahoo, perhaps all those new people buying PC’s don’t bother changing their default search engine anymore.

Why is Google a buy at the price of 500 dollars a share? You buy something like that if you are not tryig to grow you rmoney but rather keep it at a specific small growth rate.

How much higher can Google go anyway? What happens once it hits the cieling and most people who can possibly use it are? When MS owned +90% of the internet browser and OS market, did people buy MS and expect it to go up?

My opinion is that Gogle is too expensive and its P/E (price to earnings - actual earnings) ratio is too high. Its price will go down etheir today or 2 years from now. It can not sustain its 40+ ratio. It is over valued.

Deal with it.

Oh yeah…. and the resession might not help either LOL

Google the best

Google is too commercial project

Google is banking Android to deliver the much needed growth. But apart from the possibility of a big hit with Android, what else has Google got up its sleeve.

It amazes me that the Big Three Web Titans such as Google, Microsoft and Yahoo, have no ideal as to what will be the next big thing on the Web.

They are all just firmly fixed on making their Search and Ads Platform deliver their only goods.

But from all of the other great services that they offer, they do not know that they all hold on their hands, key services that can make the next big thing happen, right here right now.

I wish I could be on the board of the above Three Titans and show them that they have the smart services that can be packaged as the next big thing?

Google has proved to be a one-trick pony so far in commercial terms, albeit a hugely successful one-trick pony. However, their dependence on online advertising has a natural limit in that not everything in the world is suited to being advertised on the internet (eg goods and services that don’t lend themselves to being sold online). For such items it is hard for advertisers to connect click-throughs to sales, and therefore they can’t easily measure the ROI of their marketing spend.

Is TC now a site just for analysts? I’m a programmer not a fucking stock analyst. WTF is ‘organic growth’? Does Google need to buy more fertilizer?

But Google is the most provider for web publisher to get earning. Hope google grow and grow.

Yes, they do, which is why they are launching JUNK like Knol.

What is the news in this? EVERY business goes through a maturation process and Google is no exception. I remember in the early 80s I worked for IBM and during that high grown period people used to extrapolate IBM’s growth rate and say that by the year 2000 IBM’s revenue would be bigger than the GNP of significant countries and greater than 1% of the US GNP. Fundamentally, it can’t be.

No company can grow faster than the GNP forever whether it is Google, IBM or Microsoft (or Starbucks or McDonald’s for that matter) or it becomes a country’s GNP.

Not only this, their ad sense revenue is also on decline, but i am sure google Apps will take care of future growth.

Inorganic growth is always a challenge, especially when it comes to integrating technology and people.

As the web moves towards convergence of apps it will be a challenge for leading players to integrate their web apps without compromising on usability. What they need is Business Technology Re-engineering (BTR), for more on BTR, read my bloghttp://www.kreeo.com/blog/sumeet

Thats why for kreeo.com we choose to develop our own content management platform and framework using open technologies

Many people dont know that most of google’s revenue growth in the last 2 years came from eCPM revenue optimization (via quality score) than organic traffic growth. IMO, there is not much left to extract in this area.

Since the total search pie is not growing that fast and google has >90% marketshare in most countries and nearing that in US, i wonder how they can grow beyond 20% from 2009??